- eBoat Newsletter

- Posts

- eFoil Overview!

eFoil Overview!

⚡️ Answering the question: Is it time to go electric on the water?

Issue 113. Not a subscriber?

Join here for free.

🏄🏾♂️ 2025 e-Foil Guide: Specs, Range, Fit

A concise, current rundown of leading e-foils, with specs and who each suits (not a complete list of eFoils).

Lift’s new LIFT5 tightens integration and trims weight without losing range. The Gen5 Full Range battery is 2.2 kWh and weighs 17.5 kg (38.5 lbs). Lift quotes about 90 minutes “on power,” with setup weight around 32 kg (71 lbs) depending on board size. The 4'4" Pro sits at 55 L and targets lighter riders who want a reactive feel. Lift’s LCS tool-less system simplifies assembly and swaps between prop and jet. Beginners should choose larger boards and slower wings for stability; advanced riders can size down for tighter carving. Link

Fliteboard Series 3 remains the category’s battery benchmark. Flitecell Explore is 2.1 kWh, 14.5 kg (32 lbs), and yields up to 2.5 hours of foil time in efficient setups. Flitecell Sport drops to 1.6 kWh and 10.6 kg (23.4 lbs) for a livelier board with about 1.5 hours. The Nano is 806 Wh at 6.2 kg (13.7 lbs) for short, light sessions and wave riding. Flite’s ecosystem spans beginner to race wings, a clear path from first flights to advanced speeds. New buyers can start with Fliteboard or Flitescooter plus Explore battery, then step down in size. Link

Awake’s Vinga lineup leans into modularity and enclosed-jet safety. The Flex XR 4 battery lists 2.55 kWh, 18.5 kg (40.8 lbs), and up to 120 minutes in Vinga Adventure or Ultimate depending on conditions. Awake pairs click-in batteries with robust jets to protect riders and reduce debris snags. The Vinga 3 family emphasizes easy starts and stable trim, which suits mixed-experience groups and charter use. First-time buyers prioritizing protected propulsion and fast battery swaps will appreciate the system. Link

Waydoo Flyer One Plus pushes accessibility with integrated cases and a cordless battery drop-in. The PowerFlight Cell is 32,500 mAh (about 1.68 kWh), 13.7 kg (30.2 lbs), and fast-charges in roughly two hours. Waydoo quotes up to 120 minutes of ride time and top speeds near 40 km/h (25 mph) depending on rider and wing. The platform’s value is the straightforward setup, strong app support, and wing options for low-speed lift. New buyers who want lower cost of entry and simple logistics should shortlist it. Link

Aerofoils’ Audi e-tron foil targets premium stability and speed with polished safety features. The brand claims up to 55 km/h (34 mph) in performance wing sets and riding times around 90–120 minutes in moderate conditions. The package focuses on predictable pitch and smart electronics, appealing to riders who want high speed with a plush, composed ride. First-time buyers stepping from sailing or yachting may prefer its manners and accessories. Link

SiFly’s current range underlines beginner stability with big-volume boards and a powerful direct-drive motor. The PowerCell LR is 2.3 kWh with up to 120 minutes of ride time and a quoted 2.5-hour recharge. SiFly highlights an 8 kW drive and an adjustable stabiliser that helps riders tune lift as skills progress. New buyers focused on easy first flights on lakes and bays will find the large boards forgiving and the battery endurance generous. Link

Takuma’s Carver 2 keeps things simple and light. Retailer data lists a 4 kW drive, top speeds near 35 km/h (22 mph), and about 70–90 minutes depending on battery size. The 35 A pack emphasizes interchangeability and IPX8 resistance, and the updated remote adds clearer telemetry and a boost mode. New riders who prefer a nimble, surf-style carve at moderate speeds—and want readily available parts—will be comfortable here. Link

⚙️ Electric Marine Sector Update

The electric marine sector is moving from early adopter craft toward mainstream propulsion platforms. Adoption is strongest in defined-route use cases such as rentals, tourism fleets, and short-haul commercial operations, where range limits and charging logistics are manageable. In premium leisure boating, demand exists for silent operation and low maintenance, but many buyers still expect “gas-like” refueling convenience. Infrastructure remains a constraint, even as coastal corridors and higher-power marina charging begin to appear.

Key trends

Demand

Defined-route fleets lead adoption: rentals, resorts, tour operators, water taxis

Premium leisure grows, with range anxiety and charging access as purchase friction

Total cost of ownership messaging strengthens in high-utilization fleets

Technology

Bundled systems expand: motor + batteries + controls + charger + app telemetry

Hybrid solutions anchor mid-to-large vessels where power and range requirements rise

Marina fast charging begins to roll out, with limited coverage relative to boating routes

Go-to-market

Dealer and installer networks shape purchase decisions as much as product features

“Platform” ecosystems replace standalone component purchasing

Warranty length and service responsiveness drive trust and resale value

Emerging threats

Charging density stays below cruising needs, limiting mainstream conversion for open-water leisure routes

Safety and compliance burdens increase as lithium and marine electrical standards tighten, raising certification cost and liability exposure

Incumbent channel control stays strong through dealer relationships, parts availability, and service reach

Customer trust gaps persist without long warranties, clear end-of-life battery plans, and consistent service coverage

Disruptive innovations to watch

Industry consolidation: Yamaha’s acquisition of Torqeedo accelerates scale, manufacturing leverage, and channel reach

High-power electrification from incumbents: Volvo Penta expands electric IPS offerings aimed at integrated helm-to-propulsion systems

Route-based charging models: marina DC fast charging and corridor approaches support predictable operations for fleets and tourism routes

📅 Social Media Post of the Week

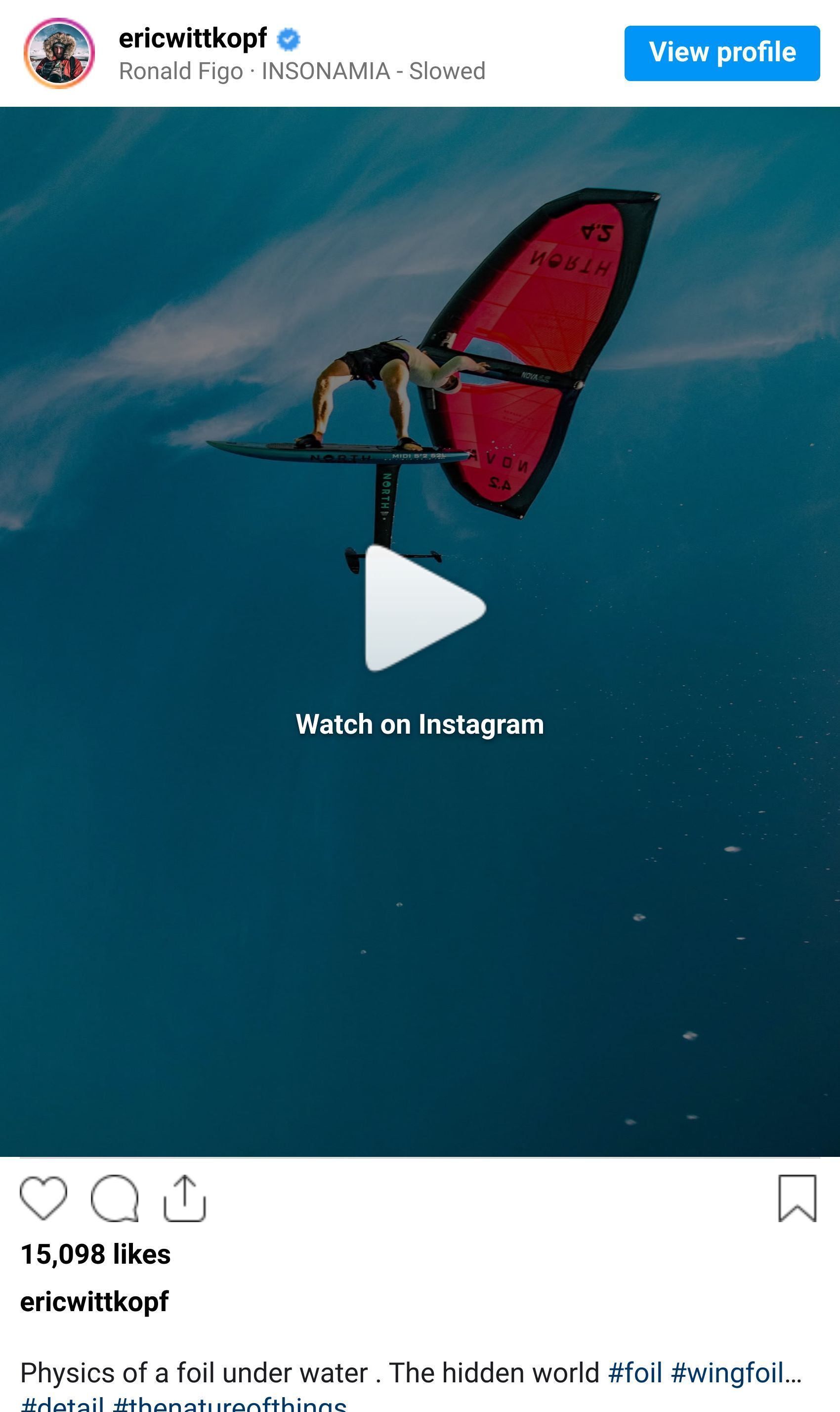

While not electric, this week’s link shows the underwater view of a foil and the associated turbulence in the water.

🖌️ Weekly Scan and Upcoming Events

Navier’s founder makes the case for hydrofoil transit | 2025-11-30 | Business Insider | Mainstream attention on efficient electric hydrofoils could unlock public and private pilots. | Link

Torqeedo debuts upgraded electric motors at Metstrade | 2025-11-27 | Powerboat & RIB | New Cruise and Deep Blue updates widen options for repowers and OEM integrations. | Link

$37M+ flows into electric outboards and hydrofoils | 2025-11-27 | Plugboats | Capital continues to back electric propulsion startups despite tight funding conditions. | Link

Vision Marine posts FY results after Nautical Ventures deal | 2025-11-28 | Vision Marine (Investors) | Dealer network scale and retail footprint matter for accelerating electric adoption. | Link

Columbia-class bow arrives at Electric Boat Groton | 2025-11-24 | CTInsider | Infrastructure and workforce expansion ripple across the regional marine supply chain. | Link

E1 reveals 2026 all-electric raceboat calendar | 2025-11-24 | E1 Series | A growing race circuit boosts awareness and technology transfer to consumer craft. | Link

boot Düsseldorf returns with strong electric footprint | 2026-01-17 | boot Düsseldorf | Europe’s biggest winter show is a key launchpad for motors, batteries, and foils. | Link

Discover Boating Miami International Boat Show | 2026-02-11 | DBMIBS | North America’s marquee stage for electric debuts, partnerships, and dealer signings. | Link

If you are finding this newsletter interesting or valuable, please help us by sharing this on social media and/or forwarding the registration link to a friend or colleague.